According to money education charity Credit Action, UK personal debt grows by £171million every day - £7.13million an hour, £119,000 a minute or almost £2,000 a second. What is causing us to continually get into debt?

One of the key issues for people in debt is their frame of mind. Subconscious mind responds to habitual thinking and whatever you give your subconscious, it registers it so be careful blaming others and complaining about your current situation.

You get more of what you focus on. If you focus on poverty and debt, you will tend to get more of that in your life. If you focus on wealth that you already have, you will tend to get more of that as well. If you cannot see the wealth you have already, just count the things you have that money cannot buy.

When someone talks about all the bills they have to pay, blame others and get aggressive there is usually “more to the story.” It is a very stressful situation but being in control and making a decision is a great first step. If you are going to be debt free, you have to believe that you are capable of making it happen. You have to believe in yourself. Past is past. There is no point in blaming yourself or the others for your current financial situation.

Why you got into debt needs to be also addressed. Why did you feel the urge to use the credit cards for things perhaps weren’t even necessary? What causes your compulsive shopping?

There might be number of emotional factors that contribute to our spending habits. Over spending might be due to boredom,low self esteem, childhood influences, equating spending with happiness, anxiety, stress, feeling better, guilt etc.

Facing the answers can be uncomfortable, but if you don’t face them, you may never get out of this vicious circle or control your spending and your debt.

Some people believe how much money they have determines their worth. A person's worth has nothing to do with how much money he/she has. It might be easier said than done however you truly need to believe this in your heart. Your worth has nothing to do with your wealth or lack of it. Once you believe this, your ability to create more abundance in your life will be more possible.

Overspending has many different causes, but it is important to remember that they all have solutions. Perhaps when you use credit cards, you don’t feel like you are spending your own money. Most people are much less likely to buy when paying with cash as opposed to credit cards. Leaving your credit cards at home or destroying them is a great way to keep an eye on your spending. Use cash or a debit card instead. Another way to deal with your habit to overspend is let some one else take charge. Family members or your spouse might be able to help you by buying things for you. You decide a budget and hand over the money to them. Seasonal sales can also lead you to overspend. If you are going to make the most of seasonal sales, buy only when you really need something.

Right now, your subconscious mind with the limiting beliefs may be keeping you from living in abundance and financial success, but as you begin to build up a positive attitude about yourself and about money, you’ll attract positive things into your life. As you do so, you’ll feel less of a need to generate positive emotions by purchasing things, and you’ll find it easier to stop buying items you don’t really need.

Carry nothing els

There are hundreds of blogs, books, web sites and debt consultancy firms to help you in getting rid of debt. Some of them offer good advice about the psychological aspects of money and spending that you’d do well to consider. Asking for help is a powerful secret to happiness and success once you make a decision. Don't hold yourself back by asking for the information, assistance, time and support.

Changing your attitude, looking at things differently and asking for assistance could make your dreams come true. Choose one action and do it. Make a complete list of your debts and creditors. Some people panic at this point but still go ahead and do it. Your debt is not a permanent condition. It's a situation. You didn't always have it; you won't have it forever. Make a decision of leaving debt behind and take an action. You cannot get out of debt by borrowing more money. You know what to do!

If you are not living your dream life, and do not have joy, peace, harmony and in your life, it is time to make changes. As it has been quoted by Einstein, "Insanity is doing the same thing over and over again but expecting different results."

Towards a new future

Most of us have the potential to be successful in life. It all depends on determined we are to be successful. It is time to face our inner sense of deprivation and take action in the direction of changing it. Make sure your thoughts and beliefs are in alignment with your desired outcome. Complaining about your current situation, talking about it, blaming, getting angry will not help. It is essential that you focus only on the outcome you desire,and not the lack of whatever it is that you desire. The more you look for the good, sooner and more often you will find it.

There is a classic book I recommend you read: Think and Grow Rich by Napoleon Hill. If you want to be rich, you need to think like one! What we think and what we say to ourselves becomes our reality. Our beliefs and thoughts do become our reality. This is probably why people who struggle financially. Their emotions and subconscious mind often do the talking and run their lives.

“If you think you can, or you think you can’t, then you’re right.” Henry Ford

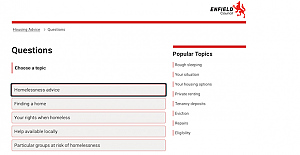

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green David Lammy arrives in Downing Street after becoming deputy prime minister

David Lammy arrives in Downing Street after becoming deputy prime minister CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots

CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality”

Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality” Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege

Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege Enfield Labour Calls for Public Feedback on Crime and Safety Concerns

Enfield Labour Calls for Public Feedback on Crime and Safety Concerns Important Travel Updates: London Underground and DLR Strike Action

Important Travel Updates: London Underground and DLR Strike Action Team Enfield ranks fifteenth the in London Youth Games

Team Enfield ranks fifteenth the in London Youth Games Champions League, Liverpool lose at Galatasaray

Champions League, Liverpool lose at Galatasaray Liverpool flew out for their Champions League match against Galatasaray

Liverpool flew out for their Champions League match against Galatasaray Enfield Council has approved plans for Surf London

Enfield Council has approved plans for Surf London Zlatan Ibrahimović receives UEFA President’s Award

Zlatan Ibrahimović receives UEFA President’s Award Enfield’s Crews Hill and Chase Park shortlisted for potential New Town

Enfield’s Crews Hill and Chase Park shortlisted for potential New Town Important milestone achieved with no hotel placements for temporary accommodation

Important milestone achieved with no hotel placements for temporary accommodation London tube strike shuts down services as TfL website crashes

London tube strike shuts down services as TfL website crashes HMRC TARGETS ERRORS IN MARGINAL RELIEF CLAIMS

HMRC TARGETS ERRORS IN MARGINAL RELIEF CLAIMS