This past year has been marked by ongoing efforts to recover from the economic impact of the global pandemic. Inflation has emerged as a significant concern, influenced by persistent disruptions in the supply chain and geopolitical tensions. To address these economic challenges, the Government has adjusted tax policies to balance revenue generation with support for businesses and individuals. The regulatory environment has experienced continuous flux, requiring businesses and individuals to be adaptable in order to stay compliant.

The Chancellor of the Exchequer, Jeremy Hunt, presented his 2023 Autumn Statement to Parliament on 22 November 2023, publishing the supporting documents, while the Office for Budget Responsibility (OBR) published updated forecasts for the UK’s economic and fiscal outlook.

The Chancellor said the Autumn Statement set out “growth measures to back British business” and “measures to make work pay”, two themes we expect to see revisited in the Spring Statement.So, as we conclude the tax year, we look ahead with anticipation for potential future reforms. This highlights the importance of adaptability and resilience in tax planning and navigating the fiscal landscape.With that in mind, we crafted this year-end tax guide to provide you with insights, enabling you to start the new tax year on solid ground. In this guide, you’ll find succinct summaries of the primary tax reliefs and allowances applicable for the remaining months of 2023/24.

Each section is accompanied by a set of planning points, serving as a practical checklist to help you consider all essential areas.If you have any questions or want to delve deeper into your tax planning, please reach out to us. We’re here to assist you in navigating the financial year.

PERSONAL ALLOWANCES AND RELIEFS

Minimising your personal tax bill.

ISAs

Using your ISA allowance.

PENSION CONTRIBUTIONS

Saving for retirement.

INHERITANCE TAX

Planning for the future.

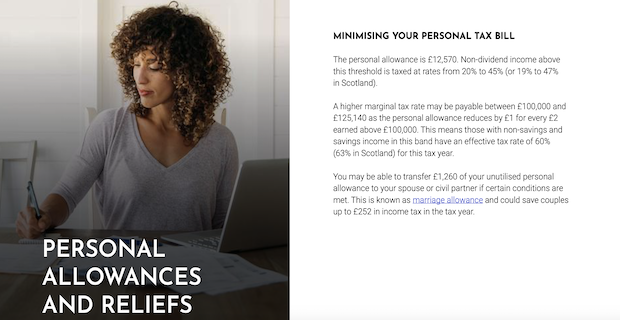

PROPERTY TAXES

Taxes related to your property.

CAPITAL GAINS TAX

Rules, exemptions and allowances.

BUSINESS ASSET DISPOSAL RELIEF

YEAR-END TAX GUIDE 2023/24

CGT when selling your business.

NON-DOMICILED TAX

Tax and your domicile status.

TAX-EFFICIENT STAFF BENEFITS

Tax saving tips for businesses.

CORPORATION TAX

Understanding the changes.

VAT

Navigating the VAT system.

PENALTIES

The cost of non-compliance.

The way in which tax charges (or tax relief, as appropriate) are applied depends on individual circumstances and may be subject to future change. ISA and pension eligibility depend on individual circumstances. FCA regulation applies to certain regulated activities, products and services, but does not necessarily apply to all tax-planning activities and services. This document is solely for information purposes and nothing in it is intended to constitute advice or a recommendation. While considerable care has been taken to ensure the information contained in this document is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information.

Get in touch for tax-planning advice

020 8886 9222

293 Green Lanes, London, N13 4XS

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green David Lammy arrives in Downing Street after becoming deputy prime minister

David Lammy arrives in Downing Street after becoming deputy prime minister CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots

CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality”

Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality” 102nd Anniversary Celebration Ball of the Republic of Türkiye in London

102nd Anniversary Celebration Ball of the Republic of Türkiye in London Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege

Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege Enfield Labour Calls for Public Feedback on Crime and Safety Concerns

Enfield Labour Calls for Public Feedback on Crime and Safety Concerns Important Travel Updates: London Underground and DLR Strike Action

Important Travel Updates: London Underground and DLR Strike Action Champions League, Liverpool lose at Galatasaray

Champions League, Liverpool lose at Galatasaray Liverpool flew out for their Champions League match against Galatasaray

Liverpool flew out for their Champions League match against Galatasaray Enfield Council has approved plans for Surf London

Enfield Council has approved plans for Surf London Zlatan Ibrahimović receives UEFA President’s Award

Zlatan Ibrahimović receives UEFA President’s Award Maritime Finance and Sustainability Take Centre Stage at LISW25 Gala Dinner

Maritime Finance and Sustainability Take Centre Stage at LISW25 Gala Dinner London welcomes traders back to the reopened Seven Sisters Market

London welcomes traders back to the reopened Seven Sisters Market Enfield’s Crews Hill and Chase Park shortlisted for potential New Town

Enfield’s Crews Hill and Chase Park shortlisted for potential New Town Important milestone achieved with no hotel placements for temporary accommodation

Important milestone achieved with no hotel placements for temporary accommodation