The new year marks the start of new beginnings, so there’s no better time to revisit your personal financial strategy. Drawing up an economic plan with clear, achievable goals can improve your long-term financial health and help protect you and your family against external factors. Whether you’re putting a personal financial plan together for the first time or you want to revisit your strategy, here are a few personal financial planning tips to help you secure your financial future in 2024.

HOW TO APPROACH YOUR PERSONAL FINANCIAL STRATEGY

LOOK AT YOUR CURRENT FINANCIAL SITUATION

Before embarking on your personal financial planning journey, you’ll need to conduct a thorough analysis of your present situation. The better you understand your circumstances, the easier it will be to plan and budget accordingly. Working out your net worth or pinning down the value of your assets and liabilities can be a little more challenging for those with more complex financial affairs – for example, if you’re a shareholder in a business or own a large investment portfolio.

SET YOUR GOALS FOR 2024

Once you know where you stand financially, you can start plotting out

the year ahead. Establishing clear and achievable financial goals is crucial for guiding your efforts throughout the year.Perhaps you want to pay off debt, invest in property, put money aside for your children’s education or build up a rainy day fund. Whatever your ambitions, setting measurable, time-bound objectives can make it easier for you to stay on the road to financial success.

YOUR BUDGET

A crucial piece of the goal-setting puzzle is your personal budget. Your budget should align with your current circumstances and financial goals.Think about what you’re spending at the moment, how much you’re earning and how much money you need to save to meet your goals.

Get in touch to discuss your personal financial strategy for 2024.

ADPL LLP

293 Green Lanes, London, N13 4XS

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green David Lammy arrives in Downing Street after becoming deputy prime minister

David Lammy arrives in Downing Street after becoming deputy prime minister CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots

CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality”

Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality” 102nd Anniversary Celebration Ball of the Republic of Türkiye in London

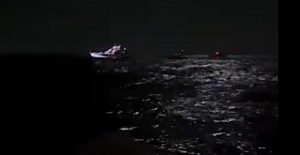

102nd Anniversary Celebration Ball of the Republic of Türkiye in London Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege

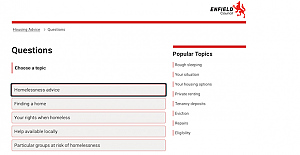

Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege Enfield Labour Calls for Public Feedback on Crime and Safety Concerns

Enfield Labour Calls for Public Feedback on Crime and Safety Concerns Important Travel Updates: London Underground and DLR Strike Action

Important Travel Updates: London Underground and DLR Strike Action Champions League, Liverpool lose at Galatasaray

Champions League, Liverpool lose at Galatasaray Liverpool flew out for their Champions League match against Galatasaray

Liverpool flew out for their Champions League match against Galatasaray Enfield Council has approved plans for Surf London

Enfield Council has approved plans for Surf London Zlatan Ibrahimović receives UEFA President’s Award

Zlatan Ibrahimović receives UEFA President’s Award Maritime Finance and Sustainability Take Centre Stage at LISW25 Gala Dinner

Maritime Finance and Sustainability Take Centre Stage at LISW25 Gala Dinner London welcomes traders back to the reopened Seven Sisters Market

London welcomes traders back to the reopened Seven Sisters Market Enfield’s Crews Hill and Chase Park shortlisted for potential New Town

Enfield’s Crews Hill and Chase Park shortlisted for potential New Town Important milestone achieved with no hotel placements for temporary accommodation

Important milestone achieved with no hotel placements for temporary accommodation