The Resolution Foundation said Philip Hammond had delivered £55bn in tax cuts and increases in public spending.

It said that richer households would feel the most positive effects.

However, the report highlighted that many of the cuts to welfare announced in 2015 are still to be rolled out.

That includes the £1.5bn benefits freeze for people in work which the foundation said would see a low income couple with children up to £200 a year worse off.

The Resolution Foundation, a not-for-profit research and policy organisation, said it was the top 10% of households that would gain most - around £410 a year - from the decision to increase the amount people can earn before they start paying income tax and the higher rate of tax.

Poorer households would gain around £30 a year.

Who benefits?

Speaking to the BBC's Today programme, the chancellor pointed out that he had allocated an extra £6.5bn for Universal Credit and raised the Living Wage.

"If you look at all the measures in the Budget - and we've done this very carefully - you will see that it is those on the lowest incomes that proportionately benefit the most," he said.

The Resolution Foundation said that with borrowing far lower than expected and economic growth predicted to be slightly higher over the next two years, Mr Hammond decided to spend three quarters of the £74bn extra headroom that was provided by the better public finances.

"The chancellor was able to navigate the near impossible task in his Budget of easing austerity, seeing debt fall and avoiding big tax rises, thanks to a £74bn fiscal windfall," said Torsten Bell, the director of the foundation.

"He chose to spend the vast majority of this on the NHS, income tax cuts and a welcome boost to Universal Credit.

"But while yesterday's Budget represented a seismic shift in the government's approach to the public finances, it spelt an easing rather than an end to austerity - particularly for low and middle income families."

Mr Bell said the chancellor had made "very welcome" commitments to helping people on the new Universal Credit benefit but that three-quarters of the benefit cuts announced in 2015 were still to take effect.

"Income tax cuts announced yesterday will overwhelmingly benefit richer households, with almost half of the long-term gains going to the top 10% of households," Mr Bell said.

"On public services the NHS saw a big spending boost - but unprotected departments still have further cuts pencilled in."

This Budget has certainly seen a turnaround in the government's approach to the public finances - with day-to-day spending per person set to rise by 4% a year until 2023 - in contrast with a 4% fall previously planned.

In his Budget yesterday, Mr Hammond said that the "hard work" of the British people was paying off "and the era of austerity was finally coming to an end".

BBC NEWS

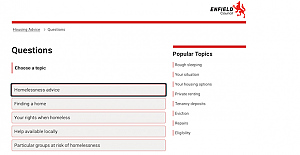

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green David Lammy arrives in Downing Street after becoming deputy prime minister

David Lammy arrives in Downing Street after becoming deputy prime minister CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots

CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality”

Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality” 102nd Anniversary Celebration Ball of the Republic of Türkiye in London

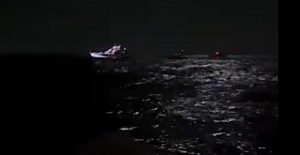

102nd Anniversary Celebration Ball of the Republic of Türkiye in London Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege

Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege Enfield Labour Calls for Public Feedback on Crime and Safety Concerns

Enfield Labour Calls for Public Feedback on Crime and Safety Concerns Important Travel Updates: London Underground and DLR Strike Action

Important Travel Updates: London Underground and DLR Strike Action Champions League, Liverpool lose at Galatasaray

Champions League, Liverpool lose at Galatasaray Liverpool flew out for their Champions League match against Galatasaray

Liverpool flew out for their Champions League match against Galatasaray Enfield Council has approved plans for Surf London

Enfield Council has approved plans for Surf London Zlatan Ibrahimović receives UEFA President’s Award

Zlatan Ibrahimović receives UEFA President’s Award Maritime Finance and Sustainability Take Centre Stage at LISW25 Gala Dinner

Maritime Finance and Sustainability Take Centre Stage at LISW25 Gala Dinner London welcomes traders back to the reopened Seven Sisters Market

London welcomes traders back to the reopened Seven Sisters Market Enfield’s Crews Hill and Chase Park shortlisted for potential New Town

Enfield’s Crews Hill and Chase Park shortlisted for potential New Town Important milestone achieved with no hotel placements for temporary accommodation

Important milestone achieved with no hotel placements for temporary accommodation