AVRUPA TIMES/ENGLAND-Chances are, it’s been a tough year so far: in the 12 months to May 2023, the consumer prices index of inflation rose by 8.7% and the bank rate is 5%. A skills shortage and the cost of energy continue to hurt businesses.However, the Institute of Directors’ (IoD) index for business leader optimism stabilised at -6 in May, much improved from the -64 we saw in November 2022.According to the IoD’s surveys, 55% of business leaders even expect revenues to rise in the year, compared to 19% who expect theirs to fall. Another 35% expect to increase their headcount in the next year, compared to 14% who expect it to reduce.So, with 2023 still marked by an air of uncertainty, how are you going to make sure your business doesn’t just survive, but thrives in the current economic climate?

BUSINESS TAX PLANNING

Businesses face a tough tax treatment in 2023: corporation tax is higher for some companies, the income tax threshold remains frozen, and the capital gains tax and dividends tax allowances have been reduced.Therefore, a great place to start with your mid-year review is to check whether your business is as tax-efficient as possible and create a tax plan.

Allowable expenses

Every tax plan will be different according to each business, but most can reduce their tax burden by claiming every allowable expense possible. By offsetting these against your pre-tax profit, you reduce the figure HMRC applies a tax rate to — ultimately reducing your tax bill.To be allowable for tax purposes, expenses must be incurred “wholly and exclusively” for business purposes. So, training courses, staff expenses, stock for resale, raw materials, business travel, marketing costs, home office costs and uniforms (but not ‘regular’ clothes you wear to work) — they’re all allowable, as long as they fit HMRC’s criteria.The most important part of allowable expenses is to ensure that your bookkeeping and record keeping is up to scratch — if you lose a receipt for an expense, for example, you’ll struggle to convince HMRC you actually purchased the item.

Capital allowances

If you purchase longer-life assets, you may be able to write off their value from your pre-tax profit through capital allowances.Some, like the annual investment allowance (AIA) and temporary full expensing scheme, allow you to claim the full amount of certain assets in the same year you purchased them.Then there’s the writing-down allowance, which a lot of companies use if they exceed the AIA limit (£1 million) orthe asset does not qualify for the AIA or full expensing. This scheme lets them claim 6% or 18% of the value of an asset each accounting year, depending on the asset.Finally is the first-year allowance, which allows you to claim the full cost of specific assets like electric cars andrefuelling equipment.

For more information ADPL LLP | www.accountingdirectplus.com/ | 020 8886 9222 | [email protected]

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green David Lammy arrives in Downing Street after becoming deputy prime minister

David Lammy arrives in Downing Street after becoming deputy prime minister CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots

CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality”

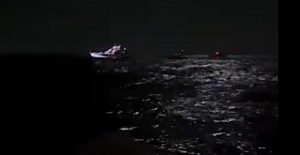

Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality” Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege

Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege Enfield Labour Calls for Public Feedback on Crime and Safety Concerns

Enfield Labour Calls for Public Feedback on Crime and Safety Concerns Important Travel Updates: London Underground and DLR Strike Action

Important Travel Updates: London Underground and DLR Strike Action Team Enfield ranks fifteenth the in London Youth Games

Team Enfield ranks fifteenth the in London Youth Games Champions League, Liverpool lose at Galatasaray

Champions League, Liverpool lose at Galatasaray Liverpool flew out for their Champions League match against Galatasaray

Liverpool flew out for their Champions League match against Galatasaray Enfield Council has approved plans for Surf London

Enfield Council has approved plans for Surf London Zlatan Ibrahimović receives UEFA President’s Award

Zlatan Ibrahimović receives UEFA President’s Award Maritime Finance and Sustainability Take Centre Stage at LISW25 Gala Dinner

Maritime Finance and Sustainability Take Centre Stage at LISW25 Gala Dinner London welcomes traders back to the reopened Seven Sisters Market

London welcomes traders back to the reopened Seven Sisters Market Enfield’s Crews Hill and Chase Park shortlisted for potential New Town

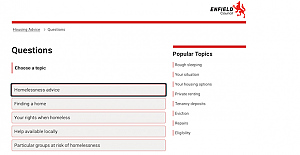

Enfield’s Crews Hill and Chase Park shortlisted for potential New Town Important milestone achieved with no hotel placements for temporary accommodation

Important milestone achieved with no hotel placements for temporary accommodation