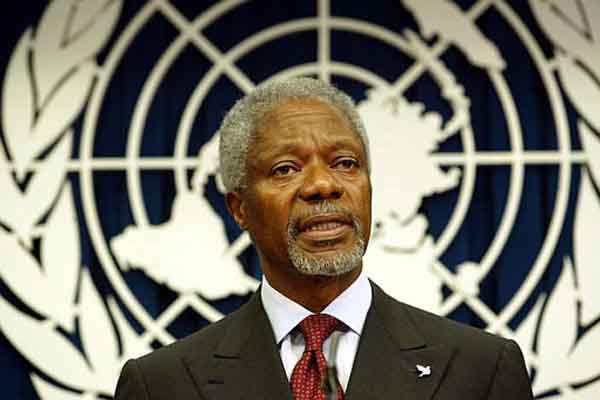

The Democratic Republic of Congo lost at least $1.36 billion in potential revenues between 2010 and 2012 due to cut-price sales of mining assets to offshore companies, according to a panel led by former U.N. secretary general Kofi Annan. Firms that shift profits to lower tax jurisdictions cost Africa $38bn (£25bn) a year, says a report produced by a panel he heads. "Africa loses twice as much money through these loopholes as it gets from donors," Mr Annan told the BBC. It was like taking food off the tables of the poor, he said. Congo, among the most mineral-rich countries in Africa, has long been under fire for opaque resource deals, many involving offshore shell companies, and last year the International Monetary Fund halted planned loans. "No country better illustrates the high costs associated with opaque concession trading than the Democratic Republic of the Congo," the Africa Progress Panel said in a report released on Friday at the World Economic Forum Africa.

"Total losses from the five deals reviewed were equivalent to more than double the combined annual budget for health and education in 2012."

The annual report, on challenges associated with natural resources in Africa, said there was no inference of illegality on the part of political leaders or the companies involved.

"However, the potential scale of the overall losses merits further investigation in order to clarify the circumstances surrounding the transactions, and to determine whether or not the assets in question were knowingly undervalued," it said.

The panel's investigators said copper and cobalt assets were sold by state miner Gecamines in complex deals involving offshore companies and miners including Glencore, now Glencore Xstrata, and ENRC.

Both ENRC and Glencore have denied any wrongdoing.

"We estimate the losses from the five deals at $1.36 billion. Assets were sold on average at one-sixth of their commercial value," the report said.

It did not say how the commercial value was estimated.

The role of shell companies and non-mining investors acting as intermediaries in Congo's mining sector has long contributed to accusations of corruption and a reputation for poor transparency.

Congo's mining minister disputed the report's findings.

"How many times have we spoken about these assets, of ENRC, of Glencore, of the Virgin Islands? I've answered these questions many times," Martin Kabwelulu said.

"In any case, I know that the Congo has lost nothing, these assets were ceded in total transparency."

"We are not getting the revenues we deserve often because of either corrupt practices, transfer pricing, tax evasion and all sorts of activities that deprive us of our due," Mr Annan told the BBC's Newsday programme.

"Transparency is a powerful tool," he said, adding that the report was urging African leaders to put "accountability centre stage".

Mr Annan said African governments needed to insist that local companies became involved in mining deals and manage them in "such a way that it also creates employment".

Kofi Annan, 'Stop looting of Africa's resources'

ex-UN chief Kofi Annan says Tax avoidance, secret mining deals and financial transfers are depriving Africa of the benefits of its resources boom...

10 Mayıs 2013 Cuma 08:47

reads.

The candidates vying to be the next London mayor

The candidates vying to be the next London mayor Enfield Council commits to anti-racism and diversity pledge

Enfield Council commits to anti-racism and diversity pledge President Erdogan promised supporters his party would learn its lessons from the defeat

President Erdogan promised supporters his party would learn its lessons from the defeat Mayor of London and London Assembly elections

Mayor of London and London Assembly elections Off duty Police sergeant Eren Emin catch suspected thief while on stag do

Off duty Police sergeant Eren Emin catch suspected thief while on stag do A Century of Urban Transformation, Istanbul’s Evolution

A Century of Urban Transformation, Istanbul’s Evolution Future Painters Exhibition at Tottenham Hotspur Stadium

Future Painters Exhibition at Tottenham Hotspur Stadium Models of Teaching International Journalism for Sustainable Development

Models of Teaching International Journalism for Sustainable Development English Premier League leaders Arsenal will visit title contenders

English Premier League leaders Arsenal will visit title contenders Liverpool meet Atalanta and West Ham face Bayer Leverkusen

Liverpool meet Atalanta and West Ham face Bayer Leverkusen Arsenal face Bayern Munich and Manchester City play Real Madrid

Arsenal face Bayern Munich and Manchester City play Real Madrid UK Transfer deadline day, the transfer window closes tonight

UK Transfer deadline day, the transfer window closes tonight Petrol prices on UK forecourts hit 150p a litre

Petrol prices on UK forecourts hit 150p a litre Europe's travel strikes: Flight and train disruption you can expect in April

Europe's travel strikes: Flight and train disruption you can expect in April Enfield Council website achieves digital inclusion recognition

Enfield Council website achieves digital inclusion recognition Enfield Council’s Planning Enforcement team goes from strength to strength

Enfield Council’s Planning Enforcement team goes from strength to strength