As you probably know by now, the UK fell into recession at the end of 2023, following a successive quarterly decline in Gross Domestic Product (GDP) in the last three months of the year.But how does that affect regular people? Well, the government can use growing GPD as evidence that it's doing a good job of managing the economy. Likewise, if GDP falls, opposition politicians tend to say the government's running it badly.If GDP is going up steadily, people pay more in tax because they're earning and spending more. This means there's more money for the government that it can choose to spend on public services, such as schools, the police and hospitals.

GDP can be measured in three ways:

Output: The total value of the goods and services produced by all sectors of the economy (agriculture, manufacturing, energy, etc)

Expenditure: The value of goods and services bought by households and by government, investment in machinery and buildings - this also includes the value of exports, minus imports

Income: The value of the income generated, mostly in terms of profits and wages

'The economy is basically flat' - ONS

Let's hear now from Liz McKeown, director of economic statistics at the Office for National Statistics (ONS), which published today's figures.Speaking to our colleagues on Radio 4's Today programme, she says that while the UK fell into recession in December, many experts believe the "broader picture" of the economy should be considered.Despite a fall in GDP at the end of the year, the overall picture is that 2023 was "basically flat", McKeown explains, and that in other countries this would not necessarily be classed as a recession.Asked what's behind these latest figures, she says a number of things have played a part - from "weak retail sales in December", through to strikes in the healthcare sector, and lower school attendances.

Some market stall owners in Shrewsbury, in the West Midlands, have told the they're experiencing good footfall and business at the start of the 2024.John Painter, who runs fruit and vegetable stall JP Fruits at Market Hill in Shrewsbury, says he can remember the market from the 1970s onwards."Whenever there's been a recession, the market's been good - people come to the market for good value," he tells, adding that recent improvements to the market have meant "trade's been wonderfully good".Angela and Tom (in the clip below) say similar - Tom in particular reports having a "slight slow down" during Christmas but says it's "definitely increasing now". This ties in with the theory that the recession at the end of last year may be short-lived.

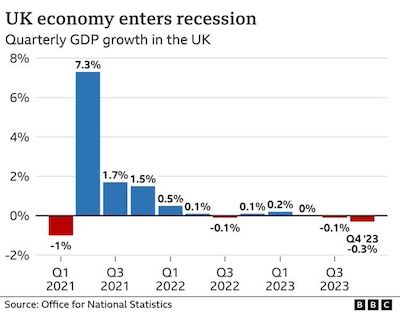

The UK fell into recession in the second half of 2023, new GDP figures show

GDP shrank by 0.3% in the last three months of 2023 - October to December

That follows a fall of 0.1% in the previous quarter, July to September

Despite GDP falling in successive quarters, it did grow by 0.1% across the whole of 2023, the data shows

One of Rishi Sunak's five pledges for 2023 was to "grow the economy"

The last time the UK's economy was in recession was 2020, during the Covid pandemic

GDP is an important tool for judging how well an economy's doing - it's measured by looking at a country's output, expenditure and income

Six key things to know this morning

If you're just joining us, or need a recap, the main thing to know is that the UK fell into recession at the end of last year - but it was mild and forecasters believe it'll be short-lived.The Office for National Statistics announced that Gross Domestic Product (GDP) fell by 0.3% in the last three months of 2023 - and because this was the second quarter in a row where GDP fell, the UK entered a recessionBut it was the mildest start to a recession since the 1970s, with the last five in the UK seeing the economy shrink by more than 1% - in 2023 it shrunk by 0.5%.The ONS figures show that all major sectors - services (by 0.2%), production (1%) and construction (1.3%) - contracted but it's thought the dip may not last long because the UK jobs market remains strong and wage growth is outpacing inflation Overall, there was also some growth last year - albeit weak - with GDP growing overall by 0.1%, in comparison with the year before.Chancellor Jeremy Hunt insists the economy is "turning a corner" but admits low growth is "not a surprise" at the moment - while shadow chancellor Rachel Reeves says PM Rishi Sunak's promise to grow the economy is in "tatters".The UK is not alone, though - the EU narrowly avoided recession in the second half of 2023 and Japan slipped into one just last night

BBC. Faisal Islam: Should we care that the UK is in recession?

Britain is now officially in recession.

Gross Domestic Product, or GDP, fell by 0.3% in the last three months of 2023, which is a sharper fall than economists were expecting.

This gave us two consecutive falls in GDP after a decrease of 0.1% in the three months before, between July and September 2023.

A fall in the economy, in two consecutive three month periods, has been the most widely used rule of thumb for entering a recession, across the world for decades.

More on that in a moment.

The best way to define the overall experience of the past six months, indeed the past two years, is "zero growth" or "stagnation".

This is a matter of note, of concern, and looks set to improve only marginally over the course of this year. It was the prime minister himself who decided to set a vague target around growing the economy by the end of last year.

Around the world, there are different definitions of recession.

In the US, a committee of eight respected private economists sits and decides if there has been "a significant decline in economic activity that is spread across the economy and that lasts more than a few months". This determination often occurs over a year after the event, and is based on monthly rather than quarterly data, and not just the size of the economy. It is more thorough, more grounded in economic theory, but less timely.

Under the US definition in 2022, two consecutive quarters of contraction was not deemed to be a recession, because of the strength of the jobs market. Under this US approach, the UK would not necessarily be in recession.

'Barmy'

But back to why a recession is now usually defined as two consecutive quarters of economic decline.

My predecessor as economics editor, Peter Jay, told the Today programme in late 2008 - just ahead of the Great Recession - that the definition was "barmy", and that it was made up on the "back of an envelope" in 1967 by the respected economist Art Okun, to help his boss US President Lyndon B Johnson out of a political hole.

Mr Johnson wanted to avoid recessionary headlines following one quarter's contraction, and so Okun suggested defining it as two quarters instead. Other sources suggest Okun floated this idea in a speech in the early 1960s. Baron Jay was "in the room" when this rather consequential piece of strategising occurred 65 years ago.

This definition has stuck around the world, except in North America.

For the most part, two consecutive quarters of GDP decline have coincided with what all economists agree have been recessions. There are exceptions though, as in the US in 2022.Indeed, it is of some relevance that the government itself has used the "two quarters" definition.

The 'R-Word'

In his Budget speech last year, Chancellor Jeremy Hunt told MPs: "Today, the Office for Budget Responsibility forecasts that, because of changing international factors and the measures I take, the UK will not now enter a technical recession this year."

This refrain was consistently used by government ministers last year.

At BBC News, as with almost all other media, we have consistently used this definition too, over decades, both in our coverage of how the UK has avoided recession, and how other countries have hit that threshold.

It is, however, important to distinguish between the period of broadly zero growth we have just been experiencing and the start of substantial tangible recessions such as during the pandemic and the Great Financial Crisis of 2007-2008.

Few forecasters believe that it will last into this year. Indeed if, as expected, the economy is currently growing between January and March, it may be over even as it is officially defined.

But it clearly is of some interest, especially given the prime minister's promise to "grow the economy".

In fact, in the absence of any statistical revisions, the "R-word" could hang over the economy until mid-May.

So now we know there have been two consecutive negative quarters, we will, as consistency dictates, be using the "R-word", but we will also add appropriate context.

For many economists even what might be called a "micro" or "nano-recession", would be a somewhat benign outcome given the aftermath of the worst health crisis in a century, the worst energy shock in half a century, and 15 years of near-zero interest rates scrapped in 15 months.

But it will, rightly, illuminate a more substantive issue: this economy is not growing.

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green David Lammy arrives in Downing Street after becoming deputy prime minister

David Lammy arrives in Downing Street after becoming deputy prime minister CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots

CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality”

Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality” Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege

Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege Enfield Labour Calls for Public Feedback on Crime and Safety Concerns

Enfield Labour Calls for Public Feedback on Crime and Safety Concerns Important Travel Updates: London Underground and DLR Strike Action

Important Travel Updates: London Underground and DLR Strike Action Team Enfield ranks fifteenth the in London Youth Games

Team Enfield ranks fifteenth the in London Youth Games Champions League, Liverpool lose at Galatasaray

Champions League, Liverpool lose at Galatasaray Liverpool flew out for their Champions League match against Galatasaray

Liverpool flew out for their Champions League match against Galatasaray Enfield Council has approved plans for Surf London

Enfield Council has approved plans for Surf London Zlatan Ibrahimović receives UEFA President’s Award

Zlatan Ibrahimović receives UEFA President’s Award Maritime Finance and Sustainability Take Centre Stage at LISW25 Gala Dinner

Maritime Finance and Sustainability Take Centre Stage at LISW25 Gala Dinner London welcomes traders back to the reopened Seven Sisters Market

London welcomes traders back to the reopened Seven Sisters Market Enfield’s Crews Hill and Chase Park shortlisted for potential New Town

Enfield’s Crews Hill and Chase Park shortlisted for potential New Town Important milestone achieved with no hotel placements for temporary accommodation

Important milestone achieved with no hotel placements for temporary accommodation