The Bank of England (BoE) is likely to raise interest rates for the last time by a quarter of a percentage point to 4.5% to end the biggest tightening cycle since the late 1980s, economists told Anadolu.

The current interest rate is 4.25% after the latest 25 basis points increase at the monetary policy committee meeting in March 2023.

Central banks have been raising interest rates to tame record-high inflation, which hit economies as the recovery from the COVID-19 pandemic led to supply-demand imbalances.

The BoE started to increase rates in December 2021, from historic lows of 0.1% to 0.25%. Since then, the bank saw interest rate hikes in 11 meetings in a row.

The inflation in the country surged to a 41-year high of 11.1% in October 2022, driven by increasing food, transport, and energy prices.

The inflation stood at 10.1% in March 2023 in the UK. The government aims to reduce the inflation to 2% and keep it at this level.

"I think the cumulative effect of the tightening so far, plus another 25 basis points hike, will be enough to achieve that for the UK and obviously the cumulative tightening is playing a big role," Michael Saunders, a former rate setter at the monetary policy committee of the BoE, told Anadolu.

The BoE monetary policy committee will have its next meeting on May 11.

Saunders said the interest rate rises have already helped slow activity and reduce labor market tightness to an extent and may have helped bring inflation expectations a bit lower.

"Soon it will be a case of waiting for the full lagged effects of the tightening to work through rather than adding extra tightening. I would not want to totally rule out the possibility they hike more than a further 25 basis points but I do not think it is the most likely outcome and probably not needed either," he said.

Monetary policy changes affect the economy with a considerable lag and the peak effect on economic growth takes about a year, according to Saunders.

The latest data showed the UK economy remained flat at no growth in February, after 0.4% growth in January.

Saunders, also a senior economic advisor at Oxford Economics, said in his recent analysis that with a potential final rate rise next week, the BoE will end its tightening cycle which is already the biggest since the late 1980s.

Inflation likely to fall 8% in April

According to EY ITEM Club, a UK economic forecasting group, core, and services inflation remaining unchanged at 6.2% and 6.6%, respectively in March, alongside stronger-than-expected activity, health jobs growth and pickup in private sector pay growth, will "probably tip the balance" toward the monetary policy committee to raise rates again next week.

The group expects the bank to deliver one more rate increase in next week's meeting to 4.5%.

Martin Beck, the chief economic adviser to the EY ITEM Club, noted they still think the headline inflation will fall at pace this year, mainly reflecting strong base effects and falling wholesale energy prices.

"Less expensive energy will likely directly lower inflation, and by reducing businesses' costs, should indirectly bear down on core and services inflation. However, the recent persistence of underlying price pressures poses a risk to just how quickly inflation will fall," he said.

Headline inflation is set to fall to about 8% in April, according to Saunders, and 5-6% in the third and 3% in the fourth quarter of the year.

He expects the target level of inflation, 2%, to be reached next year.

"Monetary policy is not the only factor bringing inflation down as energy is playing a big role but that just highlights that some of the recent strength in inflation has been temporary," Saunders underlined.

According to his analysis at Oxford Economics, high-interest rates, potentially 4.5% after next week's decision, will stay at peak as the bank is not expected to start cutting rates anytime soon.

"That seems unlikely this year. Rather, the outlook is more likely to be a fairly lengthy plateau with perhaps a modest loosening in policy next year, against a background of a neutral rate that is likely still above pre-pandemic levels," he said in the analysis.

However, EY ITEM Club forecast the bank could start rates cut at the end of this year, with reductions continuing in 2024.

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green David Lammy arrives in Downing Street after becoming deputy prime minister

David Lammy arrives in Downing Street after becoming deputy prime minister CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots

CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality”

Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality” 102nd Anniversary Celebration Ball of the Republic of Türkiye in London

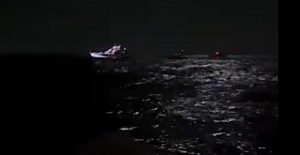

102nd Anniversary Celebration Ball of the Republic of Türkiye in London Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege

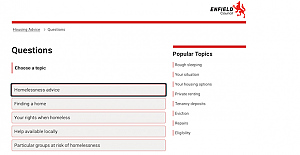

Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege Enfield Labour Calls for Public Feedback on Crime and Safety Concerns

Enfield Labour Calls for Public Feedback on Crime and Safety Concerns Important Travel Updates: London Underground and DLR Strike Action

Important Travel Updates: London Underground and DLR Strike Action Champions League, Liverpool lose at Galatasaray

Champions League, Liverpool lose at Galatasaray Liverpool flew out for their Champions League match against Galatasaray

Liverpool flew out for their Champions League match against Galatasaray Enfield Council has approved plans for Surf London

Enfield Council has approved plans for Surf London Zlatan Ibrahimović receives UEFA President’s Award

Zlatan Ibrahimović receives UEFA President’s Award Maritime Finance and Sustainability Take Centre Stage at LISW25 Gala Dinner

Maritime Finance and Sustainability Take Centre Stage at LISW25 Gala Dinner London welcomes traders back to the reopened Seven Sisters Market

London welcomes traders back to the reopened Seven Sisters Market Enfield’s Crews Hill and Chase Park shortlisted for potential New Town

Enfield’s Crews Hill and Chase Park shortlisted for potential New Town Important milestone achieved with no hotel placements for temporary accommodation

Important milestone achieved with no hotel placements for temporary accommodation