By Anthony Reuben & Tom Edgington- BBC News-National Insurance payments are increasing in April, to fund social care in England and help the NHS recover after the pandemic.But there has been criticism that the move is unfair on the lower-paid, especially when the cost of living is rising.How is National Insurance changing and what is the Health and Social Care Levy?

Employees, employers and the self-employed will all pay 1.25p more in the pound for National Insurance (NI) from April 2022.

Employees pay NI on their wages

Employers also pay extra NI contributions for staff

The self-employed pay NI on their profits

But from April 2023, National Insurance will return to its current rate.

Instead, the extra tax will be collected as a new Health and Social Care Levy.

This levy - unlike National Insurance - will also be paid by state pensioners who are still working.

National Insurance rise will go ahead, No 10 says

How much will the tax changes cost me?

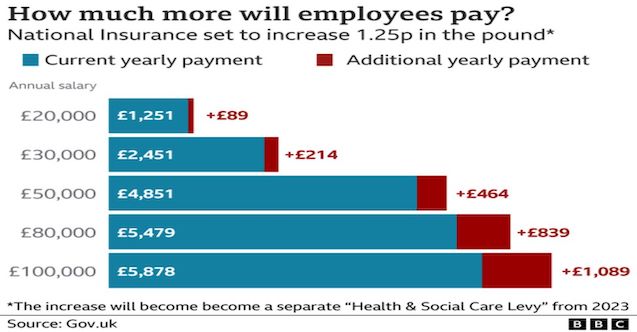

From April, people earning under £9,880 a year, or £823 a month, won't have to pay National Insurance, or the new levy when it is introduced.However, those earning more than £12,875 a year will pay more.For example, an employee on £20,000 a year will pay an extra £89 a year. Someone on £50,000 will pay £464 more.Chart showing how much extra employees will pay as a result of NI changes

National Insurance is a UK-wide tax.Although the government decision to increase it is focussed on funding health and social care in England, the tax increase is also expected to raise an additional £2.2bn for services in Scotland, Wales and Northern Ireland.line

What is National Insurance?

A tax on earnings paid by both employees and employers; the self-employed pay it on their profitsIntroduced in 1911 to provide a fund for workers who lost their job, or needed medical treatment

Now used to pay for the NHS, benefits and the state pensionThe government can also borrow from the National Insurance fund to pay for other projects

line

What are the criticisms of the tax increase?

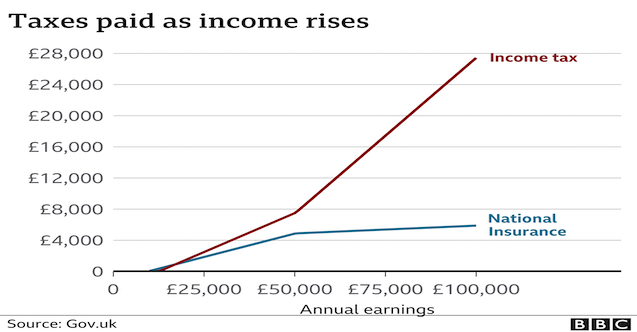

There are concerns the increase will have a higher impact on the lower-paid.This is because workers pay 12% National Insurance on earnings between £9,564 (£9,880 from April) and £50,268. However, earnings above this amount attract a rate of just 2%.So, if your income rises above £50,000, National Insurance takes a smaller proportion of your wages.The Health and Social Care Levy will work the same way as National Insurance.Chart showing how income tax and NI owed increases as income rises. Updated 7 SeptThe government is also going back on a promise made in its 2019 election manifesto not to raise National Insurance.However, Boris Johnson said the increase was because of Covid and the burden it placed on the NHS.

What is the tax increase for?

The government says the changes are expected to raise £12bn a year.Initially, this will go towards easing pressure on the NHS .

A proportion will then be moved into the social care system.This mainly helps older people and people with high care needs, with tasks such as washing, dressing, eating and taking medication.The aim is to make sure people in England pay no more than £86,000 in care costs from October 2023 (not including accommodation and food).Anyone with assets - like their home, savings and investments - worth less than £20,000 will have their care fully covered by the state.Those with between £20,000 and £100,000 in assets will have their care costs subsidised.What could care changes cost you and your family?

What's the present arrangement?

At present, to get your care paid for by your local council, you must have a very high level of need and also savings and assets worth less than £23,250 in England.Below that level the amount you pay reduces until you have less than £14,250, at which point the council pays for your care if you qualify.The care system is under pressure because of an ageing population and the pandemic. It has been hit by staff shortages and falling government spending.This has also put pressure on the NHS because people cannot be discharged from hospital if they don't have anywhere suitable to go.

Social care: Nine challenges facing the system

What happens in the rest of the UK?

In Wales, no-one who is eligible for care at home is expected to pay more than £100 a week.In Northern Ireland, no-one over the age of 75 pays for home care.Scotland provides free personal care for people who are assessed as needing support at home, whatever their age.In Scottish care homes, people get free care if they have savings or assets of less than £18,000.Those with savings and assets of between £18,000 and £28,750 have to fund part of their care.People with more than that have to fund their own care, apart from a £193.50 a week contribution towards personal care and £87.10 a week towards nursing care.

UPDATE: Figures for how much the increase in National Insurance will cost were updated to take into account the rise in the primary threshold from April 2022 in line with inflation.

Prime Minister Keir Starmer's 2025 Easter message

Prime Minister Keir Starmer's 2025 Easter message After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights

Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council

Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council UK AMBASSADOR TO TURKEY VISITS FETHIYE

UK AMBASSADOR TO TURKEY VISITS FETHIYE Journalists from Europe held the Turkish Media Workshop in Skopje

Journalists from Europe held the Turkish Media Workshop in Skopje The European Union called on Turkey to uphold democratic values

The European Union called on Turkey to uphold democratic values Turkish citizens in London said Rights, Law, Justice

Turkish citizens in London said Rights, Law, Justice The 'Prince of Paris' has impressed in his first EuroLeague season

The 'Prince of Paris' has impressed in his first EuroLeague season Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years

Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years Will Rangers be Jose Mourinho’s next victim?

Will Rangers be Jose Mourinho’s next victim? Jose Mourinho's Fenerbahce face Rangers on Thursday

Jose Mourinho's Fenerbahce face Rangers on Thursday Residents welcomed back to Edmonton Leisure Centre

Residents welcomed back to Edmonton Leisure Centre Barclays has become the biggest UK lender so far to cut mortgage rates

Barclays has become the biggest UK lender so far to cut mortgage rates THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS

THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS Launch of Made in Enfield gift shop to celebrate local artists and designers

Launch of Made in Enfield gift shop to celebrate local artists and designers