Although not much of UK households' wealth is currently held in assets such as Bitcoin, they are becoming more mainstream, said deputy Bank governor Sir Jon Cunliffe. If their value fell sharply, it could have a knock-on effect, he said. The Bank needed to be ready to contain those risks, he added. Speaking to the BBC's Today programme, Sir Jon said that at present, about 0.1% of UK households' wealth was in crypto-currencies. About 2.3 million people were estimated to hold them, with an average amount per person of about £300. However, he stressed that crypto-currencies had been "growing very fast", with people such as fund managers wanting to know whether they should hold part of their portfolios in crypto-currencies. "Their price can vary quite considerably and they could theoretically or practically drop to zero," he said. "The point, I think, at which one worries is when it becomes integrated into the financial system, when a big price correction could really affect other markets and affect established financial market players. "It's not there yet, but it takes time to design standards and regulations." He added: "We really need to roll our sleeves up and get on with it, so that by the time this becomes a much bigger issue, we've actually got the regulatory framework to contain the risks."

Sir Jon was speaking the day after the Bank published its latest Financial Stability Report, which examined the health of the UK's financial system. The report said UK households had remained "resilient" despite the end of the furlough scheme and other Covid support measures. However, it added that uncertainty over health risks and the economic outlook remained. Covid could still have "a greater impact" on the economy, especially in light of new variants, it said. The report comes as Bank policymakers prepare to announce their next interest rate decision on Thursday. The cost of living rose by 4.2% in October, its highest rate in almost 10 years. This surge in inflation has led analysts to predict an increase in interest rates from their current record low of 0.1%. But doubts have recently set in because of the spread of the Omicron variant.

BBC News

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green

Enfield Labour welcomes new court order to stop antisocial behaviour in Edmonton Green David Lammy arrives in Downing Street after becoming deputy prime minister

David Lammy arrives in Downing Street after becoming deputy prime minister CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots

CTCA UK Condemns the Political Forcing Out of Afzal Khan MP for Engaging with Turkish Cypriots Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality”

Tatar: “Reaction to MP’s TRNC visit is yet another stark example of the Greek Cypriot leadership’s primitive and domineering mentality” 102nd Anniversary Celebration Ball of the Republic of Türkiye in London

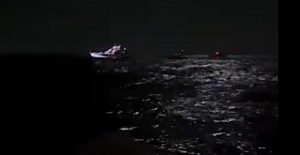

102nd Anniversary Celebration Ball of the Republic of Türkiye in London Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege

Latest! Israeli navy intercepts Global Sumud Flotilla as it approaches Gaza to break siege Enfield Labour Calls for Public Feedback on Crime and Safety Concerns

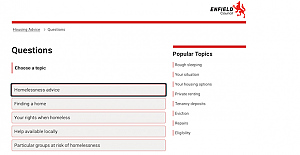

Enfield Labour Calls for Public Feedback on Crime and Safety Concerns Important Travel Updates: London Underground and DLR Strike Action

Important Travel Updates: London Underground and DLR Strike Action Champions League, Liverpool lose at Galatasaray

Champions League, Liverpool lose at Galatasaray Liverpool flew out for their Champions League match against Galatasaray

Liverpool flew out for their Champions League match against Galatasaray Enfield Council has approved plans for Surf London

Enfield Council has approved plans for Surf London Zlatan Ibrahimović receives UEFA President’s Award

Zlatan Ibrahimović receives UEFA President’s Award Maritime Finance and Sustainability Take Centre Stage at LISW25 Gala Dinner

Maritime Finance and Sustainability Take Centre Stage at LISW25 Gala Dinner London welcomes traders back to the reopened Seven Sisters Market

London welcomes traders back to the reopened Seven Sisters Market Enfield’s Crews Hill and Chase Park shortlisted for potential New Town

Enfield’s Crews Hill and Chase Park shortlisted for potential New Town Important milestone achieved with no hotel placements for temporary accommodation

Important milestone achieved with no hotel placements for temporary accommodation